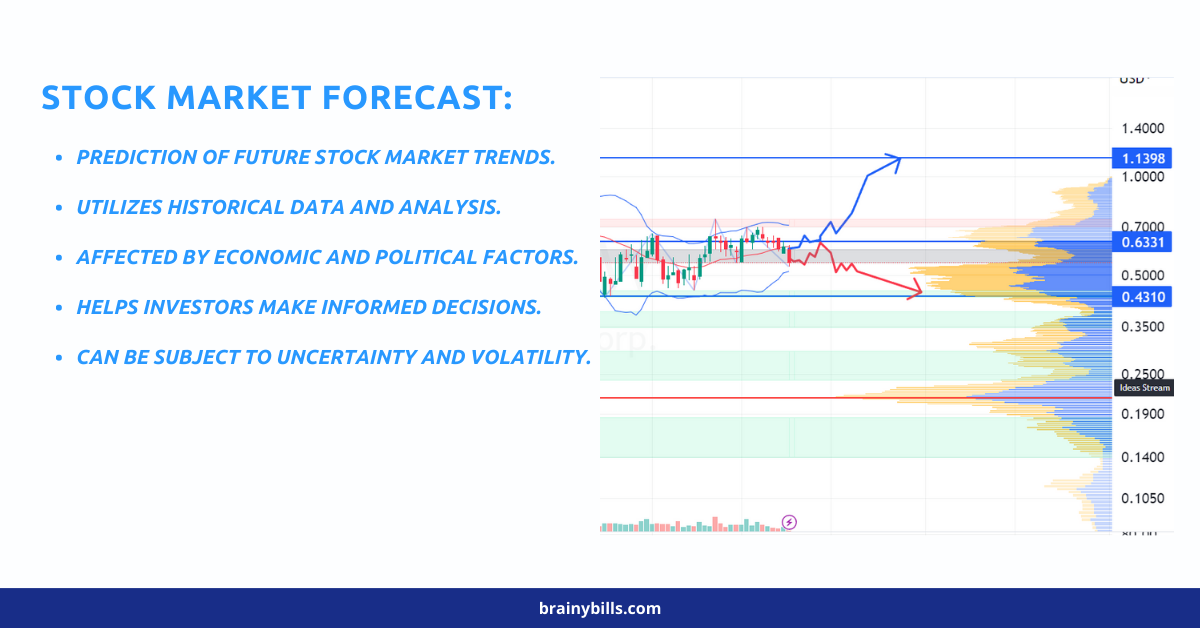

Stock market forecasting is a complex and dynamic process that necessitates a careful assessment of multiple elements. In this article, we’ll delve deeper into each method mentioned in the previous section and offer more specific insight into how investors can utilize them to make informed investment decisions.

Technical Analysis

Technical analysis is a method of forecasting that involves examining past market data to detect trends and potential trading opportunities.

Technical analysts employ moving averages, support/resistance levels, and relative strength indexes to analyze market data and forecast its future performance.

Technical analysis provides investors with the ability to identify market patterns, enabling them to make educated choices on whether to purchase, sell, or hold stocks. In addition, technical analysis may uncover possible trading opportunities, such as breakout patterns and trend reversals.

The application of technical analysis might have its limits. For example, it might be impacted by market noise and volatility, making precise projections difficult.

Fundamental Analysis

In addition, fundamental research may be used to find inexpensive companies with robust growth prospects.

The limits of fundamental analysis must be acknowledged. In addition, it does not account for market emotion or external factors, such as economic statistics or geopolitical developments, which may affect short-term performance.

Emotional Analysis

The purpose of sentiment analysis is to predict market sentiment in order to evaluate future performance. Monitoring the news and social media to determine public sentiment about equities and the market as a whole.

Sentiment research provides investors with real-time market sentiment knowledge. This enables individuals to make educated judgments on whether to purchase, sell, or keep stocks depending on sentiment shifts. Moreover, sentiment research may be used to discover prospective trading opportunities based on sentiment shifts.

Sentiment analysis is not devoid of disadvantages. For instance, market perception might be influenced by false news or social media manipulation.

Furthermore, sentiment analysis fails to take into account fundamental factors like a company’s financial health or economic indicators which could influence market performance.

Economic Indicators

Economic indicators are statistics that offer insight into the economy’s health. This includes data such as gross domestic product (GDP), unemployment rates, and inflation rates. Economic indicators can be used to forecast future market performance since they give insight into what drives each type of investment decision.

Economic indicators provide investors with a valuable perspective of the economy and its potential effects on the market. This knowledge can be used to make informed decisions about when to buy, sell or hold stocks based on economic indicators. Furthermore, changes in data may indicate potential trading opportunities. Nevertheless, economic indicators have some limitations; they could be negatively affected by external events like geopolitical conflicts or natural disasters which could negatively affect performance. Furthermore, economic indicators do not take into account company-specific aspects like financial health or industry trends that could influence stock performance.

Machine Learning

Machine learning is an advanced forecasting method that utilizes complex algorithms to analyze large datasets and make predictions about future market performance. It involves training algorithms on historical market data in order to recognize patterns and trends which can then be used as input when making future projections.

One of the primary advantages of machine learning is its capacity to analyze vast amounts of data and detect patterns not visible to human analysts. This can help investors make informed decisions about when to buy, sell, or hold stocks based on machine learning predictions. Furthermore, machine learning can also be utilized to detect potential trading opportunities based on changes in market data.

Machine learning also has some drawbacks. For instance, it requires a significant amount of computing power and data processing capabilities which can be costly and time-consuming to acquire. Furthermore, machine learning algorithms may be affected by biased or incomplete data sets, leading to inaccurate predictions.

Conclusion

Stock market forecasting is an intricate and dynamic process requiring careful evaluation of multiple factors. By using technical analysis, fundamental analysis, sentiment analysis, economic indicators, and machine learning algorithms, investors can make informed decisions on when to buy, sell or hold stocks.

Each method has its own advantages and drawbacks, so investors should carefully assess which approach best meets their investment objectives and risk tolerance. By staying abreast of market movements and using reliable forecasting techniques, investors can increase their chances of making profitable stock market investments.