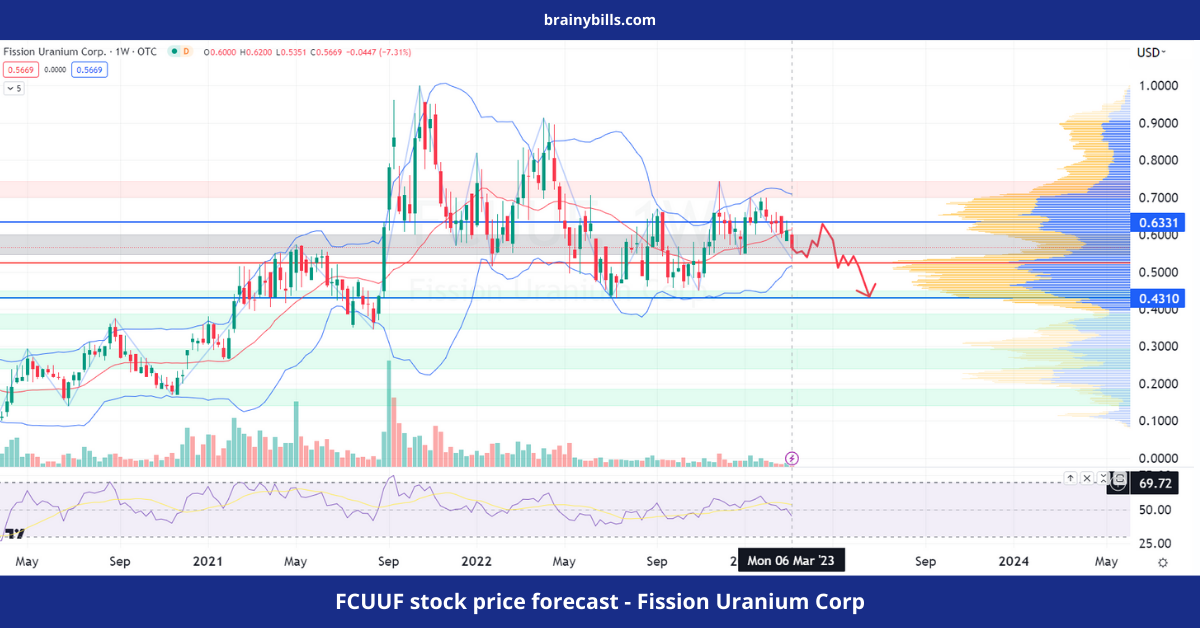

FCUUF stock prices today trade at around $0.56 per shares. The long-term trend remains accumulation, which is expected to continue. The medium-term trend ranges from $0.45 – $0.7. FCUUF stock price fell to retest $0.45 support in the next weeks. Investors can hold off on buying at this level. A trader may open a short position when the price goes above $0.65. Stop losing if the price moves up and closes over $0.72 Profits can be taken at the strong support level of $0.45

FCUUF is a Canadian-based company involved in the uranium mining sector. Its primary focus is to develop and explore properties in the Athabasca basin region of Saskatchewan, Canada. This area is known for its high-grade uranium deposits which are used as fuel for nuclear power plant.

FCUUF is known for its flagship property, Patterson Lake South in the Athabasca basinin. FCUUF is a leader in this region and has strong potential for growth. This project contains some of the finest uranium deposits on Earth.

FCUUF also owns PLS and a range of other Canadian uranium exploration project. Their strategy is to acquire, develop and maintain high-quality uranium assets with long-term growth potential for shareholders.

FCUUF should be evaluated based on the current state in the uranium marketplace. After years of excess supply and low prices, recent signs of improvement have emerged due to increasing demand for clean energy sources as well as nuclear power adoption by many countries. FCUUF, one of the companies involved in uranium mines, has seen a steady increase in uranium price.

But, the uranium marketplace is subject to many uncertainties and risks. Factors such as geopolitical tensions, government regulations, and competition coming from other energy sources may have an impact on market demand and supply dynamics. This could potentially impact a company’s profitability.

FCUUF is a Canadian-based mining company that focuses exclusively on the Athabasca basinin region. FCUUF’s flagship PLS project is home to some the finest uranium deposits in the world, making it an important asset. Although this market is not without risks, the company’s long-term prospects are good thanks to increased demand for clean energy as well as increased nuclear power generation.