For novices, the stock market can seem overwhelming with its complex terminology and hectic trading. But understanding the fundamentals of stock market analysis will empower you to make informed decisions about your investments and achieve financial success. In this article, we’ll give you a beginners guide to stock market analysis with techniques and tips for success.

Part 1:What is Stock Market Analysis in Section 1?

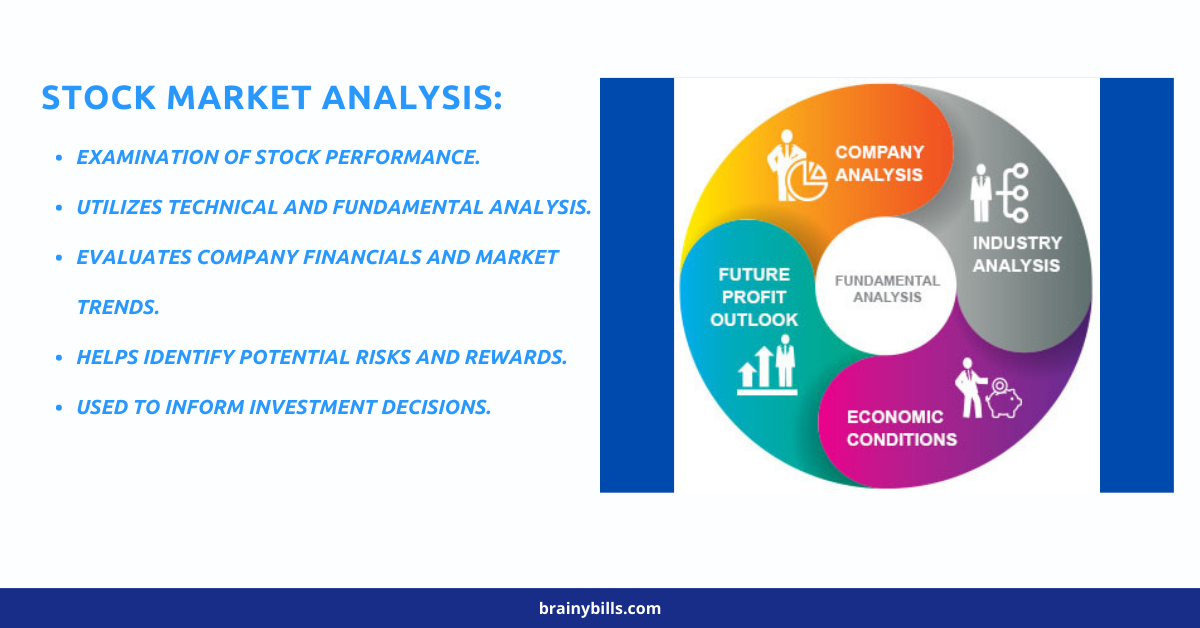

Stock market analysis is the practice of closely examining and assessing the performance of stock markets and individual companies to spot trends, patterns, and investment opportunities. Common methods used for this purpose include technical analysis, fundamental analysis, and quantitative evaluation.

Technical analysis is the practice of analyzing past price charts to detect patterns and tendencies that could be used to forecast future price movements. It relies on the idea that history repeats itself, with patterns appearing once likely recurring elsewhere as well.

Fundamental analysis on the other hand examines the economic and financial elements that determine a company’s success. It involves studying financial accounts, industry trends, and other macroeconomic elements to predict a company’s growth and profitability potential.

Quantitative analysis is the study and forecasting of stock values using mathematical and statistical models. It holds that market behavior can be explained and predicted with the help of mathematical equations and statistical formulae.

Part 2: Assessing Stock Market Relevance

In order to decide whether to buy, sell, or keep a certain stock, investors need stock market research. It can spot lucrative investing possibilities and avoid expensive mistakes. The following are some of the main benefits of undertaking such research:

Identifying Trends and Patterns: Investors may benefit from stock market research by spotting trends that might be utilized to forecast future price changes.

By analyzing past prices charts and other market data, they may be able to spot signals that could indicate a potential buying or selling opportunity.

Analysing the stock market can assist investors in assessing a company’s growth and profitability prospects.

Investors may discover firms with solid fundamentals and invest appropriately by evaluating financial statements, industry trends, and other macroeconomic data.

By identifying possible threats and opportunities inside the market, stock market research may aid investors in managing risk. By knowing market trends and patterns, investors may make informed judgments on whether to purchase or sell a certain company, hence reducing the likelihood of making expensive mistakes.

Stock market research may aid investors in enhancing their profits by identifying new investment opportunities and preventing expensive mistakes.

By understanding market trends and patterns, individuals can make informed decisions about when to buy, sell, or hold a particular stock; ultimately increasing their overall earnings.

Section 3: Techniques and Tips for Stock Market Analysis

Research and Analysis: Conducting thorough research is the initial step in stock market analysis. This includes studying company financial statements, industry trends, as well as macroeconomic factors that could impact stock prices.

Utilize Technical Analysis Tools: Use technical analysis tools like moving averages, relative strength index (RSI) and Fibonacci retracements to examine historical price charts and detect trends or patterns that could help predict future changes in prices.

Pay Attention to News and Events: Events such as earnings reports, economic indicators, and political developments can have a major impact on stock prices. Staying informed about these developments allows investors to make educated decisions about when to buy, sell or hold a particular stock.

Diversify Your Portfolio: Diversification is an essential element of stock market analysis. By investing in various stocks and other assets, investors can reduce their overall risk and improve their likelihood of financial success.